Global Payments

Send and receive B2B cross-border payments the smart way

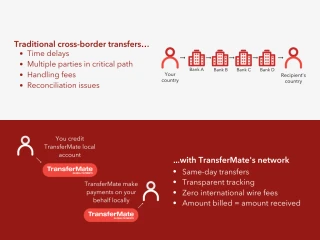

delaware brings together ERP and payment technology, eliminating the friction in the movement of funds across the globe.

An alternative to traditional bank transfer using SWIFT, businesses can now transact internationally at the most competitive forex rates, zero transaction fees with guaranteed on-time payment.

/delaware-pro-website-Solution-Page-Banner-(TransferMate).webp?mode=autocrop&w=425&h=170&attachmenthistoryguid=86f38472-c8c5-4b97-8164-342e3d96c16f&v=&focusX=1451&focusY=149&c=7e694e732594dd05ff2eacde77967846b921b40e87527125366a6de387cf3bfa)